Need help filing your taxes?

You are not alone! On this page, you will find a list of free or low cost, in-person and virtual income tax preparation services, as well as information about about how the economic stimulus payment, unemployment, Cares 2.0 stipend, and other tax updates may impact your tax filing this year.

Mission Economic Development Agency (MEDA)

MEDA offers services in Spanish and English. Call 415-612-2014 and leave a voicemail stating that you have received a Cares 2.0 stipend and need support with how to file your taxes, or email fintax@medasf.org to ask about their free tax preparation.

Earn It, Keep It, Save It (EKS)

EKS offers virtual and in-person appointments in multiple languages at over 200+ Bay Area locations. Call 211 or email EKS@uwba.org with your inquiry for tax support.

Tax-Aid

Tax-Aid

Tax-Aid offers free income tax preparation to people that earn less than $57,000 a year. Tax services are provided free of charge by volunteers who donate their time. Call 415-229-9240 or email admin@tax-aid.org to find out more! For information about the economic stimulus during the COVID-19 pandemic, see Economic Stimulus FAQs. Tax-Aid also held a webinar about how “Pandemic Payments May Affect Your 2020 Taxes” — watch the recording on Youtube (17 min).

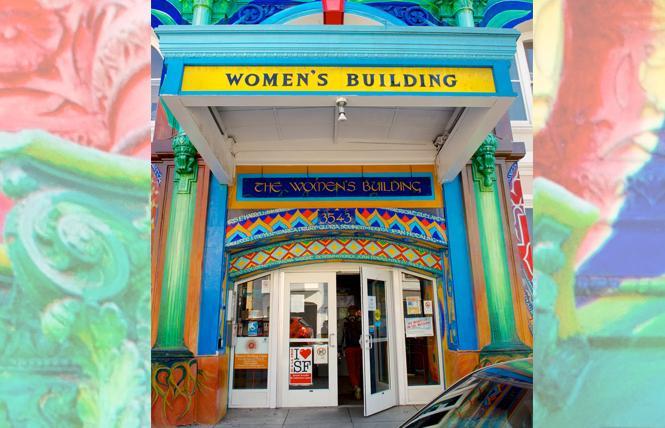

SF Women’s Building

SFWB volunteers are certified by the IRS and provide free basic income tax preparation for people who earn $54,000 a year or less. Call 415-431-1180 x11 or email abi@womensbuilding.org to schedule an appointment.

Support with Finances, Public Services, and Unemployment

Chinese Progressive Association

The CPA provides services in Cantonese, Taishanese, and Mandarin. If you have questions about your taxes, unemployment benefits, or employee rights, you can call (415) 391-6986 to request a free and confidential consultation.

Legal Aid at Work (LAAW)

LAAW provides support for work conditions, pay, breaks, etc. in English, Chinese, and Spanish throughout the state. Search their helpline phone numbers list or call 415-404-9093 to make a phone appointment.

Mission Asset Fund (MAF)

MAF seeks to offer financial stability to low-income families by facilitating zero-interest lending and simultaneous credit building. They provide multilingual financial services to immigrants, non-US citizens, youth, and low-income populations.

Wu Yee Children’s Services

Wu Yee collaborates with the Human Services Agency and community service partners to help those who need access to public benefits including CalFresh, CalWorks, Medi-Cal, PG&E CA Alternative Rates for Energy, SF Recreation & Park Family Account Program, SF Working Families Credit, Paid Family Leave (PFL), and more.

How do I claim the Cares 2.0 Stipend in my taxes?

Many of you have received one or more educator CARES 2.0 stipends and will receive a 1099 form for your taxes. Children’s Council will mail 1099 tax forms to early educators who received a total payment of $600 or more.

If you received any of the following payments from Children’s Council, you will receive a 1099-MISC (Miscellaneous):

- CDE stipends

- CARES 2.0 stipend

If you received any of the following payments from Children’s Council, you will receive a 1099-NEC (Non-employee Compensation):

- Local ELS subsidy payments: Voucher, Gap on Title 5, Preschool for All, MRA

- State Voucher subsidy payments

- QRIS Quality grants for ELS-funded programs

Please read the Children’s Council article “How do I understand my 1099 tax form from Children’s Council?” for more information. OECE offers translated information about tax resources and the Cares 2.0 stipend in English, Spanish, and Chinese.

Am I eligible for the California Earned Income Tax Credit (EITC) or Young Child Tax Credit (YCTC)?

For those who make $30,000 or less – it’s a really important time to file taxes and claim these benefits! The California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit (YCTC) are state tax credits for working Californians. CalEITC4Me provides a range of printable materials to help you understand the Earned Income Tax Credit, so working families can get the most money back in their pockets this tax season.

What is the EITC? How do I get it? Check out their multilingual fact sheets to help you get the answers to these questions and more.

No Social Security number? No problem! Taxpayers with an ITIN (Individual Taxpayer Identification Number), including undocumented immigrants, are now eligible for the CalEITC and YCTC. Visit CalEITC4Me.org or text EITC to 47177 to learn more.

The Governor also proposed an additional $600 via the Golden State Stimulus to anyone who receives the CalEITC. Families with kids under 6 can get an additional $1000. For more information, visit the CA Franchise Tax Board website.

US Government Tax Services

SF Office of Financial Empowerment (SF OFE)

SF OFE offers support to individuals that live, work or receive services in San Francisco. Their Smart Money Coaching provides free, confidential, one-on-one, personalized financial guidance with a certified financial coach in locations throughout San Francisco. They also offer information about college savings and a “Know Your Rights” campaign.

Internal Revenue Service (IRS)

IRS’s Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs offer free basic tax return preparation to qualified individuals in multiple languages. The VITA program provides free tax help to people who generally make $57,000 or less, persons with disabilities, and limited English-speaking taxpayers. The TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.